Whatever your financial plan, Sunmark has home loan options that can help you reach your goals.

If you’re just starting out or starting over and have limited funds available for a down payment, Sunmark has mortgage programs for credit-qualified individuals looking to finance up to 97% of their mortgage.

FAQWe like the lower payments of a 30-year mortgage but would also like to build equity and pay off our home more quickly. Should we go with a 15-year mortgage instead? If you’re having difficulty deciding between two mortgage terms, you might want to consider taking out a longer mortgage term to give your budget the flexibility of having a lower payment requirement — just in case — while still giving yourself the option of paying additional principal since there is no prepayment penalty. In general, mortgages with lower terms have lower interest rates making it possible to build equity in your home faster or save in preparation for retirement or a child’s education more quickly. If we want to pay extra, do Sunmark mortgages have a prepayment penalty? Sunmark mortgages have no prepayment penalty, so you can pay extra toward your principal any time you wish. We’re saving for a down payment, but worry the right house will pass us by before we reach our goals. How much down payment is enough? Sunmark has mortgage programs for credit-qualified individuals looking to finance up to 97% of their mortgage. If you’re just starting out or starting over and have limited funds available for a down payment, you may want to consider this option. My home needs a major renovation. What is my best loan option? Home renovation goals sometimes require more than one loan. If you’re looking to accomplish major home renovations, Sunmark has one answer: our 203(k) Rehab loan.

What projects are allowed with a home renovation loan? Accomplish your renovation ideas and create your dream home! A few ideas:

These loans are guaranteed and administered by the Department of Veterans Affairs and are available to qualified individuals who have served in the armed forces. If you’re a qualified veteran and wish to purchase a home, a VA loan may be right for you. For more information, check out the VA’s Home Loan Guaranty program online. We’ve built up some equity in our home and would like to take advantage of today’s lower interest rates and get lower payments. What are our refinance options? Homeowners choose to refinance their mortgages for a variety of reasons:

Sunmark can also refinance your first mortgage into a second mortgage if you have built up equity in your home. This means that we will pay off your first mortgage and roll it into a home equity loan in which Sunmark is the first lien holder. |

Unmarked Bills

Unmark a call, message, group message, or voicemail as spam If a contact's messages, calls, or voicemail automatically go into your Spam folder, that contact might be marked as spam. You can unmark numbers incorrectly marked as spam to keep future communication from that number out of your Spam folder.

Unmark

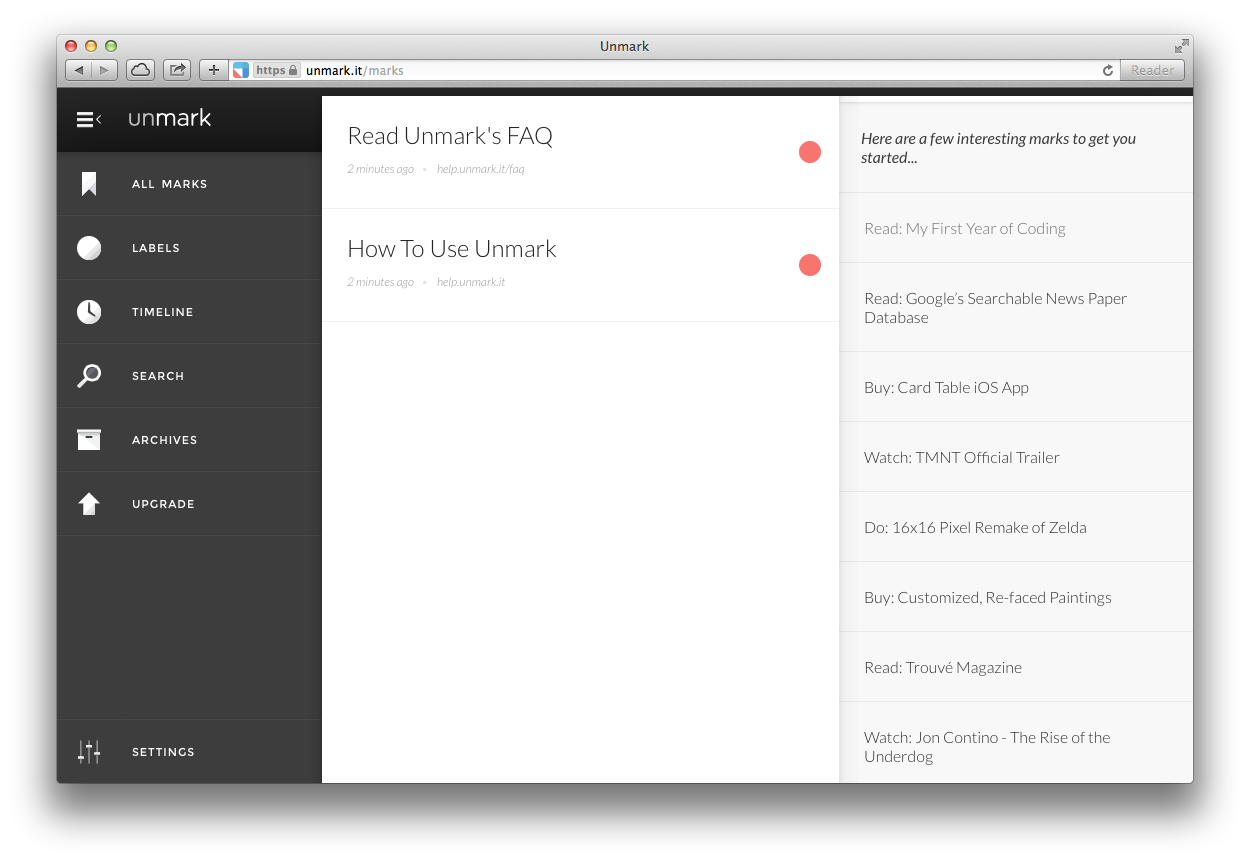

- Unmark is designed to help you actually do something with your bookmarks, rather than just hoard them. A simple layout puts the focus on your task at hand and friendly reminders keep you in line. Filtering options let you find what you're looking for.

- Characterized by the absence of a distinctive phonological feature, as (p), which, in contrast to (b), lacks the distinctive feature of voicing. Characterized by the absence of a grammatical marker, as the singular in English in contrast to the plural, which is typically marked by an -s ending.

- I can't access my account.