Even under Medicare Advantage, you must still pay your Part B premium (unless your plan helps pay for it). The standard Part B premium in 2021 is $148.50 per month. Medicare pays the rest. Starting on day 151 Medicare pays nothing. Medicare Part A also pays 100% of days 1-20 in a skilled nursing facility (rehab center). If you stay longer than 20 days your copay is $185.50 per day for days 21-100. Medicare pays after the copay has been satisfied.

- Medicare Patient Deductible For 2021

- Medicare Deductible 2021 For Prescriptions

- Medicare Part B Premium 2021

- Medicare Deductible For 2021

- Medicare Part D Copay 2021

By Kolt Legette

. A copay applies for any care received for a medical condition that’s treated or monitored during a preventive visit. We follow the Centers for Medicare & Medicaid Services (CMS) Medicare. Coverage and coding guidelines for all network services. You can view Coverage Summaries on UHCprovider.com. 2021 Medicare Costs. If your yearly income in 2019 was You pay (in 2021) File individual tax return File joint tax return File married & separate tax return. $88,000 or less $176,000 or less $88,000 or less $148.50 above $88,000 up to $111,000 above $176,000 up to $222,000 not applicable $207.90.

Since 2003, Kolt Legette has helped clients navigate the often-confusing world of insurance. His number one goal is protecting the medical and financial wellbeing of every person he speaks with, wheth ... sceler they choose to buy insurance or not. Kolt loves representing the best brands in medical insurance as it allows him to provide side-by-side comparisons for his clients. This allows the client to decide which company works best for them. By putting the needs of the client above everything else, Kolt helps real people find affordable health insurance solutions for their most pressing healthcare needs. With his belief that peace of mind is priceless, Kolt's goal in every interaction is to make sure every person he speaks to leaves with the peace of mind they rightfully deserveRead more

Generally speaking, no. This can vary a bit, depending on whether or not you have Medicare Advantage. There can also be some fees related to your doctor's visit, like prescription drug costs, that often do have a copay. We’ll go through the full structure of your out-of-pocket fees with Medicare as they relate to doctor visits, so you can know what to expect when you walk in the door.

Copay vs. Coinsurance

Copays and coinsurance fees are often discussed when you hear about your medical insurance plan. Most of the time, a copay or copayment refers to a single fee that you will have to pay when you receive health care. For example, your insurance may charge a $20 copay for each doctor visit, and you’ll have to pay this same fee no matter which services you receive at the doctor’s office.

A coinsurance functions as a percentage-based cost-sharing agreement, rather than a set fee. For example, Medicare Part B has a 20 percent coinsurance, which means that Medicare pays 80 pecent of the approved amount of your medical services, and you pay the remaining 20 percent. Some private insurance plans can have both a copay and a coinsurance for different scenarios.

Both copay and coinsurance fees will only apply after you’ve paid your annual deductible.

Does Medicare Use Copays?

Yes and no. Importantly, Part B of Medicare never uses copays. Part B has a deductible of $203per benefit period, and after this, you will pay 20 percent of your costs, which is your coinsurance. Medicare Part B covers doctor visits, as well as other things like durable medical equipment, so you will never pay a copay for a doctor visit under Original Medicare, only a coinsurance.

Mental Health Services -- The Exception

Mental health services are the one regular exception to this rule. There may be some instances in which you don't have to pay a copay for these services, but most of the time that is the arrangement that Medicare will use. Make sure to check the details with the office you are dealing with and with Medicare.

What About Part A?

Medicare Part A does not technically use a copayment, but the fees are very similar to what most people associate with copays. Part A hospital insurance uses a so-called coinsurance fee, but this fee is not percentage-based and is pre-set with a few tiers depending on the length of your skilled nursing facility or hospital stay. Because it is a pre-set fee, it does function like a copay, despite being called a coinsurance.

Copays with Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare. Although there are some regulations on these costs, there will be more variety.

This means that some Medicare Advantage plans will have copays, and others won’t. The amount of the copay will vary, and some plans may use copays for one type of care while using a coinsurance for others; it depends. If you have a Medicare Advantage plan, make sure that you know in advance what the copay is, so you can be prepared when you go see your healthcare provider.

Medicare Patient Deductible For 2021

How do Part D Prescription Drug Plans Fit In?

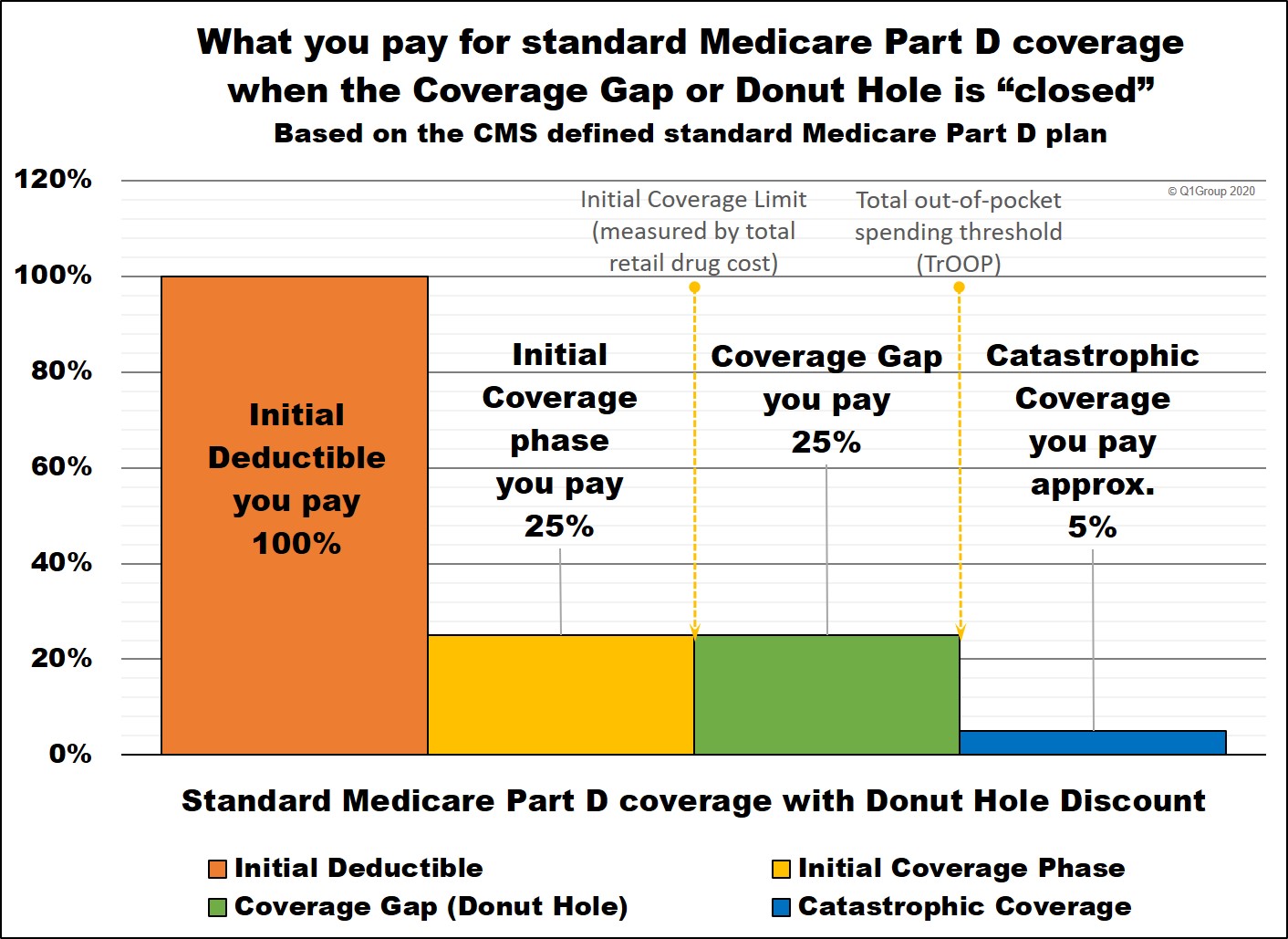

Although Part D plans usually won't apply to your actual doctor visit, they are still very relevant to the process. If your doctor prescribes you medication during your visit, it will usually be covered by a Part D plan. For this reason, you should make sure to understand the copay structure and out-of-pocket fees associated with your prescription drug plan, whether it’s Part D or another private plan.

Like Medicare Advantage plans, Part D plans are offered by private insurance companies. This means that they are also free to use copays, and the majority will. Prescription drug coverage is especially suited to copay structures since people refill their prescriptions often. If you have a Part D plan, it most likely uses a copay.

When it comes to Part D plans, there will usually be a tier list that has a higher copay for drugs higher on the list. If possible, try to know what the copay is before you go in to get your prescription filled.

Can Medigap Plans Help?

Medigap plans, or Medicare Supplement Plans, are plans that cover some of your Medicare out-of-pocket costs. With these plans, you will only pay a monthly premium, with no other out-of-pocket costs. As an example, these plans can cover your Part B coinsurance, and cover many other out-of-pocket fee categories. You can read more about Medigap plans at medicare.gov.

Medigap plans only cover out-of-pocket costs, so they won’t cover medical services. These plans only cover Original Medicare, not Medicare Advantage or Part D drug plans.

Because they don’t cover Medicare Advantage, Medigap plans won’t ever be able to pay for your copay. This is simply because there is no usual copay under Original Medicare. Some Medigap plans will cover the Part A coinsurance, which as we mentioned earlier, does function the same way as a copay.

Things to Keep in Mind

Overall, understanding copays with Medicare is simple, just don’t ignore it until the last minute! If you have a Medicare Advantage plan, make sure that you understand your out-of-pocket fees so a copay won’t surprise you. Otherwise, you'll rarely have to deal with copays with Medicare.

Related Articles

Medicare Explained 2021

Medicare is divided into 4 parts: Part A, Part B, Part C, and Part D

Original Medicare consists of Part A and Part B.

Medicare Part A (Hospital)

Covers an inpatient hospital stay specific to only Room, Board, and general nursing services.

Something important to keep in mind is going to the Emergency Room or in Observation at the hospital, DOES NOT constitute “inpatient” status. You are not considered “inpatient” until a physician formally admits you into the hospital and declares that you are an inpatient. Until you are formally admitted Part A does not kick in. Once formally an “inpatient” and Part A is activated, you are responsible for a deductible of $1,484.00 per benefit period. A deductible is due each hospital admission if 60 days exist between stays. The coinsurance after the deductible for days 1-60 is$0.00 per day of each benefit period. If you stay longer than 60 continuous days, your copay is $371.00per day for days 61-90 and $742.00per day for days 91-150. Medicare pays the rest. Starting on day 151 Medicare pays nothing.

Medicare Part A also pays 100% of days 1-20 in a skilled nursing facility (rehab center). If you stay longer than 20 days your copay is $185.50 per day for days 21-100. Medicare pays after the copay has been satisfied. On day 101+, Medicare pays nothing, and you are responsible for all charges.

There is no max out of pocket under Original Medicare for Part A or Part B.

Part A also covers Hospice and home health care following a stay in the hospital.

Medicare Deductible 2021 For Prescriptions

Medicare Part B (Medical)

Everything else Medical falls under Part B. You pay an annual deductible of $203.00 then it goes to a basic 80/20 plan. Medicare pays 80% of the Medicare approved charges, then you must pay the remaining 20%. There is a premium for Part B for most people and in 2021 that premium is $148.50 (subject to income limits). Higher income earners will pay a higher premium for Part B (IRMAA). Please visit medicare.gov for more details.

Part B includes (but not limited to):

- Doctors office visits

- In-patient surgery

- Out-patient surgery

- Blood work/lab testing

- MRI, CAT scan, CT Scan

- X-rays

- Emergency room and observation prior to admission

- Ambulance ride

- Doctor/surgeon treating you in hospital

- All hospital services rendered

Medicare Part C (Medicare Advantage Plans)

A Medicare Advantage Plan is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In many cases, you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services, to help protect you from unexpected costs. Some plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you’ll need it if you ever switch back to Original Medicare.

If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

What are the different types of Medicare Advantage Plans?

- Health Maintenance Organization (HMO) plan

- HMO Point-of-Service (HMOPOS) plan: This HMO plan may allow you to get some services out-of network for a higher copayment or coinsurance.

- Medical Savings Account (MSA) plans

- Preferred Provider Organization (PPO) plan

- Private Fee-for-Service (PFFS) plan

- Special Needs Plan (SNP) Certain health conditions

- Dual Eligible Plan (DSNP) Medicare and Medicaid eligible

What do Medicare Advantage Plans cover?

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits.Plans must cover all emergency and urgent care, and almost all medically necessary services Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Plans can offer extra benefits

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn’t cover, like some vision, hearing, dental, and fitness programs (like gym memberships or discounts). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations.

Medicare Part B Premium 2021

Part D (Drug coverage)

Medicare drug coverage helps pay for prescription drugs you need. Even

if you don’t take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage

(like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage:

Medicare Deductible For 2021

1. Stand Alone Drug Plans These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee-for-Service plans, and Medical Savings Account plans. You must have Part A and/or Part B to join a separate Medicare drug plan.

Medicare Part D Copay 2021

2. Medicare Advantage Plans You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

In either case, you must live in the service area of the plan you want to join.